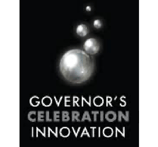

Life365 Health makes it easy to get your RPM program started and get results quickly.

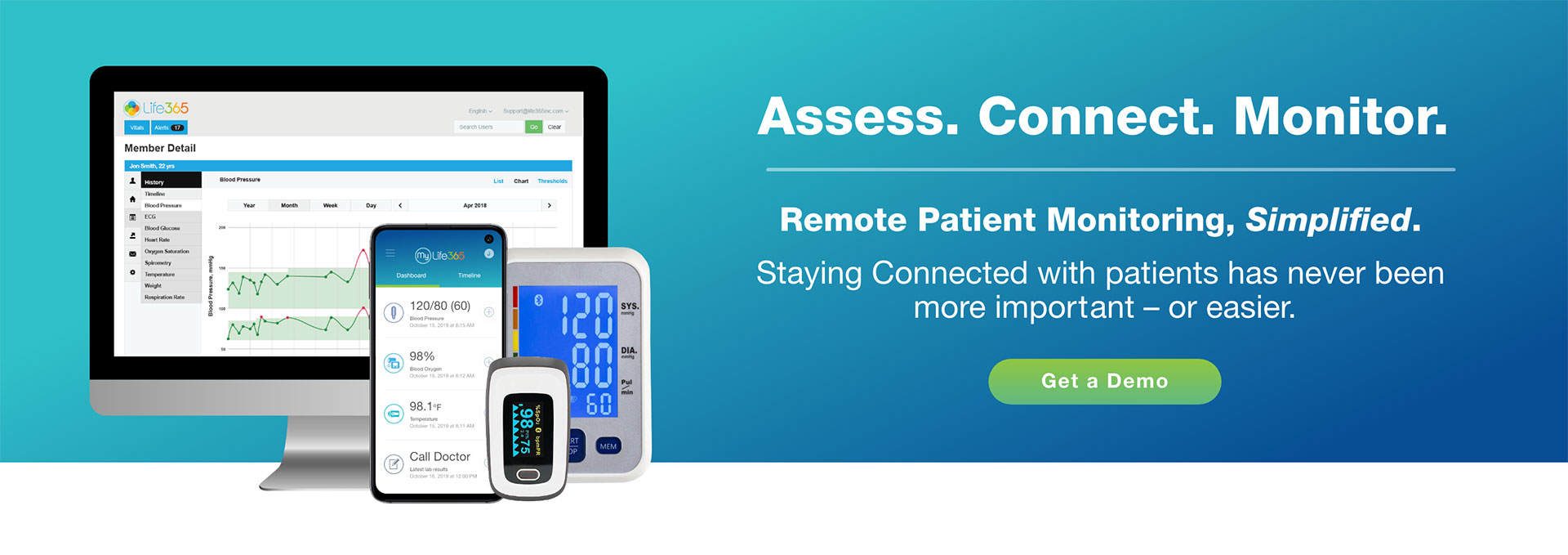

Let us help you distribute solutions to enable your remote care initiatives and manage more patients at home – efficiently and safely.

With the growing demand for your team and new reimbursement opportunities, it’s essential to bring Remote Patient Monitoring into your practice. Life365 Health’s RPM solutions will enable you to see more patients and generate revenue between real-time visits.

Life365 and Microsoft Cloud for Healthcare enable clients to extend care models to the home.

Learn how Life365 with MC4H provides the most solution options to connect with patients outside the point of care.

Leverage clinical data and personalized outreach to help close gaps in care.

Care delivery will be augmented with "early insights" that can be leveraged to intervene faster and avoid potential admissions and readmissions to the hospital.

Read more about our partnership: READ MORE HERE

Watch our videos:

- Microsoft + Life365 Customer Stories

- New Normal Webinars with Microsoft:

The Latest Microsoft Cloud for Healthcare capabilities optimize payor, provider productivity.

As the preferred RPM partner, Life365 works with MC4H to enable virtual care for enterprise healthcare organizations, making it easier for caregivers to access and track patient vitals, and gain early insights into patient health status.

Read more on Microsoft's website: READ MORE HERE

Learn how Life365 & MC4H enable better experiences, insights, and outcomes.

Life365 RPM Architecture on MC4H - At a Glance.

Health systems, hospitals, and large physician practices are shifting care to the home, leveraging remote patient monitoring technologies.

Learn how intelligent RPM solutions are designed and deployed using Microsoft - and MC4H with Life365 - to alleviate device integration challenges when building these programs at scale.

Here is what our Healthcare Partners say about Life365's Platform:

The way healthcare is delivered is constantly changing.

We concentrate around hospital readmissions reduction programs, chronic care management, including patient engagement to help reduce the cost associated with a patients care.

Working with Life365 enables us to provide care where, when and how people need it – and adapt as situations change. Their team couldn’t be more flexible.

SEAN BURTON | National Director Integrated Healthcare, American Medical Response

We engage with Life365 because the reality is in the connected world that there are tons and tons of devices and you need to be able to interface with a number of them, not just one brand and then you are creating all the interfaces which is a very very complex scenario.

We simply use a device that meets our needs. It's connected to the platform and we receive the data into our systems all behind the scenes seamlessly. There is no work on our part to do anything.

SUSAN CORDTS | CEO & Founder, Catalytic Health Partners

We know we need to move outside the 4 walls of the Hospital to a lower cost setting – Home, for a variety of reasons. We don’t want to deal with hundreds of solutions and services and have to take each one through a length on-boarding process.

We prefer to deal with one connected platform and we have that platform coordinate the vendors and make the connection from our clinical backend to home – and that’s Life365.DR. ZSOLT KULCSAR | Physician Lead Telehealth Services, White Plains Hospital

Benefits of Our RPM Solutions

Reduce Costs and Readmissions

Minimizes unnecessary costly care utilization.

Helps clinicians navigate patients to appropriate levels of care.

Faster

Interventions

Interventions

Proactively adjust therapy and provide timely intervention when needed.

The Life365 Health Difference

Flexible Connected Bundled Solutions

Experienced

Support Team

Support Team

AFFILIATES & RECOGNITIONS

.png?width=147&height=147&name=RM-Top5-badge%20(1).png)